San Diego Home Insurance Things To Know Before You Get This

San Diego Home Insurance Things To Know Before You Get This

Blog Article

Safeguard Your Home and Enjoyed Ones With Affordable Home Insurance Plans

Relevance of Affordable Home Insurance Coverage

Protecting budget friendly home insurance coverage is vital for guarding one's residential or commercial property and monetary wellness. Home insurance policy supplies protection against numerous dangers such as fire, burglary, all-natural catastrophes, and personal responsibility. By having an extensive insurance coverage plan in place, home owners can feel confident that their most substantial investment is shielded in case of unexpected circumstances.

Inexpensive home insurance policy not only provides economic safety and security yet likewise supplies peace of mind (San Diego Home Insurance). Despite increasing property worths and construction prices, having an economical insurance coverage makes certain that home owners can easily restore or repair their homes without encountering considerable financial worries

Furthermore, budget-friendly home insurance can additionally cover personal valuables within the home, offering compensation for items harmed or stolen. This insurance coverage prolongs past the physical structure of your house, safeguarding the components that make a residence a home.

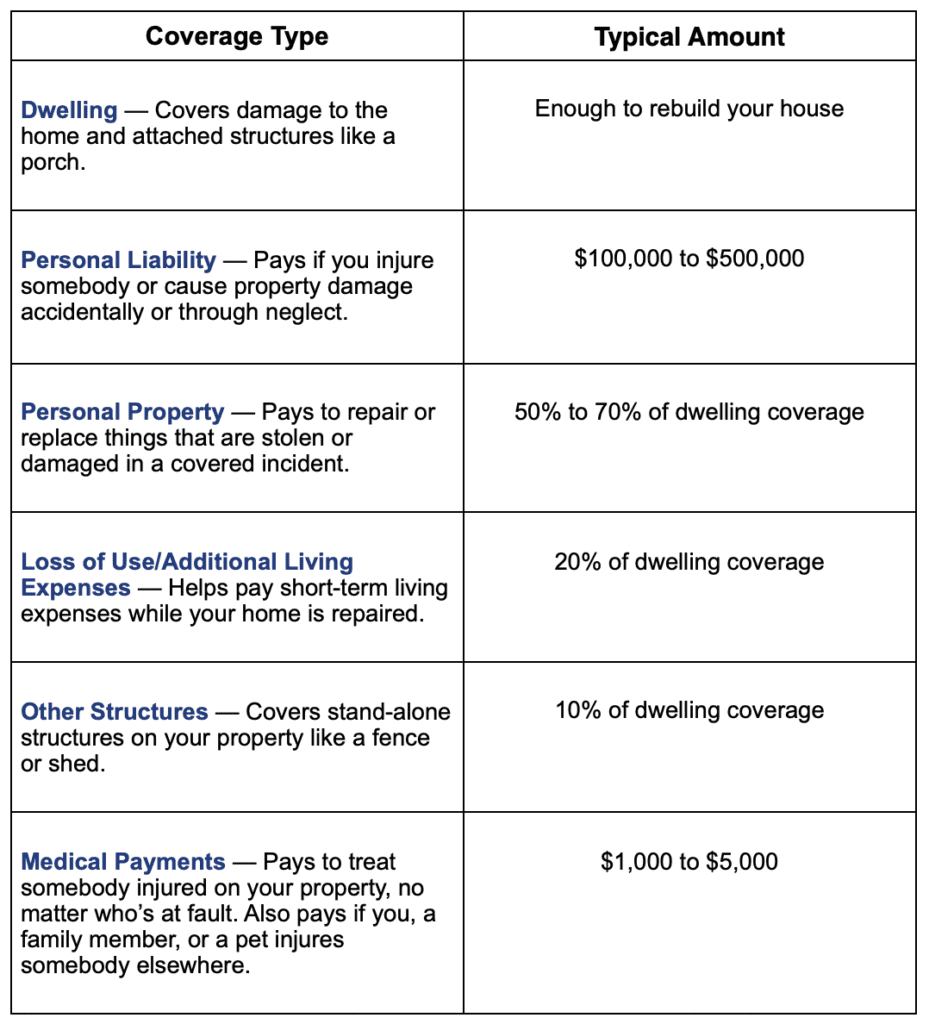

Coverage Options and Boundaries

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

When it comes to coverage limitations, it's critical to comprehend the maximum amount your plan will certainly pay for each sort of insurance coverage. These limits can vary depending upon the policy and insurance firm, so it's essential to evaluate them thoroughly to ensure you have sufficient security for your home and possessions. By comprehending the coverage options and limits of your home insurance policy, you can make enlightened choices to guard your home and enjoyed ones properly.

Variables Influencing Insurance Policy Expenses

Numerous variables significantly influence the costs of home insurance policy policies. The area of your home plays an important duty in figuring out the insurance coverage costs.

Moreover, the sort of protection you pick straight affects the expense of your insurance plan. Opting for additional coverage alternatives such as flooding insurance or quake coverage will boost your premium. Selecting higher insurance coverage limits will result in higher prices. Your insurance deductible amount can likewise influence your insurance coverage prices. A higher deductible normally means lower costs, however you will need to pay more out of pocket in case of an insurance claim.

Furthermore, your credit report, declares background, and the insurer you pick can all influence the rate of your home insurance plan. By considering these elements, you can make educated decisions to help manage your insurance costs effectively.

Comparing Providers and quotes

In addition to contrasting quotes, it is essential to evaluate the reputation and financial stability of the insurance policy service providers. Seek consumer testimonials, scores from independent agencies, and any type of history of issues or regulative activities. A reliable insurance coverage supplier should have a good track record of immediately refining claims and supplying excellent customer service.

Moreover, take into consideration the specific coverage functions offered by each company. Some insurance firms might supply fringe benefits such as identification burglary protection, equipment breakdown protection, or protection for high-value items. By meticulously comparing companies and quotes, you can make an informed decision and pick the home insurance coverage plan that finest meets your requirements.

Tips for Saving Money On Home Insurance Coverage

After thoroughly contrasting quotes and suppliers to locate the most appropriate coverage for your requirements and budget, it is sensible to explore efficient approaches for saving money on home insurance. Among the most substantial ways to save on home insurance coverage is by bundling your plans. Numerous insurance firms use discount rates page if you purchase several plans from them, such as integrating your home and car insurance coverage. Enhancing your home's protection measures can likewise bring about savings. Mounting safety and security systems, smoke alarm, deadbolts, or a lawn sprinkler system can minimize the threat of damage or theft, potentially reducing your insurance premiums. Furthermore, keeping a great credit report can positively influence your home insurance coverage rates. Insurance companies frequently take into consideration credit rating when establishing costs, this contact form so paying bills on schedule and handling your credit properly can lead to reduced insurance costs. Finally, on a regular basis assessing and upgrading your policy to show any type of changes in your house or circumstances can ensure you are not paying for protection you no more demand, helping you conserve cash on your home insurance costs.

Verdict

In verdict, protecting your home and enjoyed ones with cost effective home insurance is vital. Applying suggestions for conserving on home insurance policy can also help you secure the required security for your home without damaging the financial institution.

By deciphering the intricacies of home insurance plans and checking out sensible approaches for safeguarding economical protection, you can make sure that your home and loved ones are well-protected.

Home insurance plans normally use a number of coverage alternatives to secure your home and items - San Diego Home Insurance. By comprehending the coverage alternatives and limitations of your home insurance plan, you can make informed choices to secure your home and loved ones properly

On a regular basis examining and updating your policy to mirror any modifications in your home or situations can guarantee you are not paying for protection you no longer need, assisting you conserve cash on your home insurance policy premiums.

In final thought, protecting your home and liked ones with budget friendly home insurance policy is critical.

Report this page